As retail trading continues to grow in 2026, beginners are entering markets with more access than ever — but also greater risks. Regulators warn of high-risk behaviours among novice traders, while research shows even experienced traders struggle when execution, discipline and risk-management fail.

In this environment, knowing what not to do may be just as important as knowing the next “hot” strategy. The following five mistakes consistently undermine beginner traders — and avoiding them can be the foundation of long-term success.

Mistake 1: Trading Without a Concrete Plan

Starting trades based on hunches, tips, or emotions is gambling, not trading.

Solution: Develop a written trading plan that covers:

- Your market/instrument selection (stocks, forex, crypto)

- Entry and exit rules (e.g., technical conditions)

- Risk management: how much you’ll risk per trade

- Timeframe and strategy outline

Test your strategy on historical data or in a demo account before risking real capital.

Mistake 2: Ignoring the “1% Rule” and Poor Risk Management

Many beginners risk too much on one trade, believing they’ll strike big quickly. But a large loss can wipe out weeks or months of gains.

Solution: Use the “1% to 2% Rule” — risk only 1% (conservative) or 2% (aggressive) of your total capital on a single trade. Always use a stop-loss, and insist on a minimum risk:reward ratio (e.g., 1:2) so your winners can cover multiple losers.

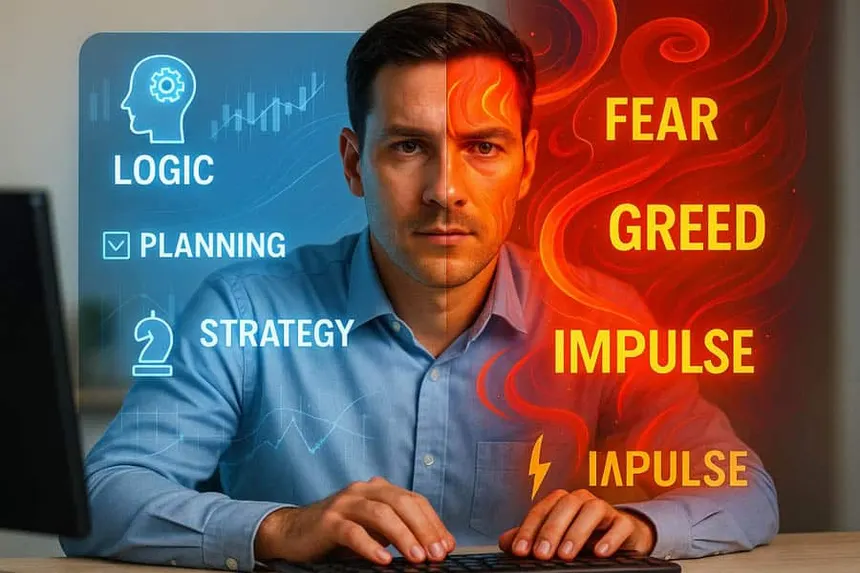

Mistake 3: Emotional Trading & Revenge Trading

When trades go wrong, emotional responses like anger, fear and greed kick in. One common pattern is revenge trading — opening an impulsive trade after a loss to “get back” the money, often resulting in larger losses.

Solution: Focus on process over outcome. Treat trading like a business. Keep a journal: record each trade, your emotional state, the setup, and the lesson. Accept losses as part of the data when you execute your plan.

Mistake 4: Overtrading and Excessive Leverage

Beginners often think more trades = more profits. This leads to forcing trades that don’t meet criteria, and using high leverage that magnifies losses.

Solution: Be patient. Wait for high-probability setups that match your plan. Use higher time-frames to reduce noise. Limit your trades and size down positions — quality over quantity.

Mistake 5: Failing to Journal and Learn from Mistakes

Without analysing your trades, it’s impossible to improve. Many skip the review process and repeat the same errors.

Solution: Keep a detailed trading journal with: date, asset, timeframe, entry/exit, rationale, emotion, screenshot, lesson. Review weekly. Identify repeat errors and tweak your strategy accordingly.

Why These Mistakes Matter More in 2026

- A large proportion of retail traders are still failing despite access to advanced tools, because execution, discipline and risk control remain weak.

- Regulators are issuing warnings: for example, novice traders being pushed into high-risk ‘professional’ bets without proper safeguards.

- Social media and algorithmic tools give the appearance of easy money, but many inexperienced traders admit regret over decisions made on those platforms.

In short: the environment is more accessible, but also more unforgiving for beginners who skip fundamentals.

Final Thoughts

Becoming a consistently profitable trader isn’t about finding the perfect indicator or strategy. It’s about discipline, process, risk-management and continual learning. By consciously avoiding these five mistakes — planless trading, poor risk management, emotional decisions, overtrading, and ignoring your own data — you build the foundation for long-term success.

I totally agree with the importance of a trading plan — it’s easy to get caught up in the excitement of the markets, but a solid plan makes all the difference in staying disciplined. I think many beginners underestimate how critical risk management is, too.